Blog

In SAP RAP (RESTful ABAP Programming), metadata annotations help define actions, UI behavior, and business logic exposure. But one limitation stands out: RAP does not allow a Download or Extract button to be created using annotations alone. This becomes a challenge when applications need to deliver ...

Organizations which use e-commerce platforms like Magento rely on seamless ERP integration to ensure accurate order fulfilment, real-time inventory visibility and smooth financial reconciliation. In our use case, when a Goods Issue (PGI) is created and Outbound Delivery is released in SAP S/4HA...

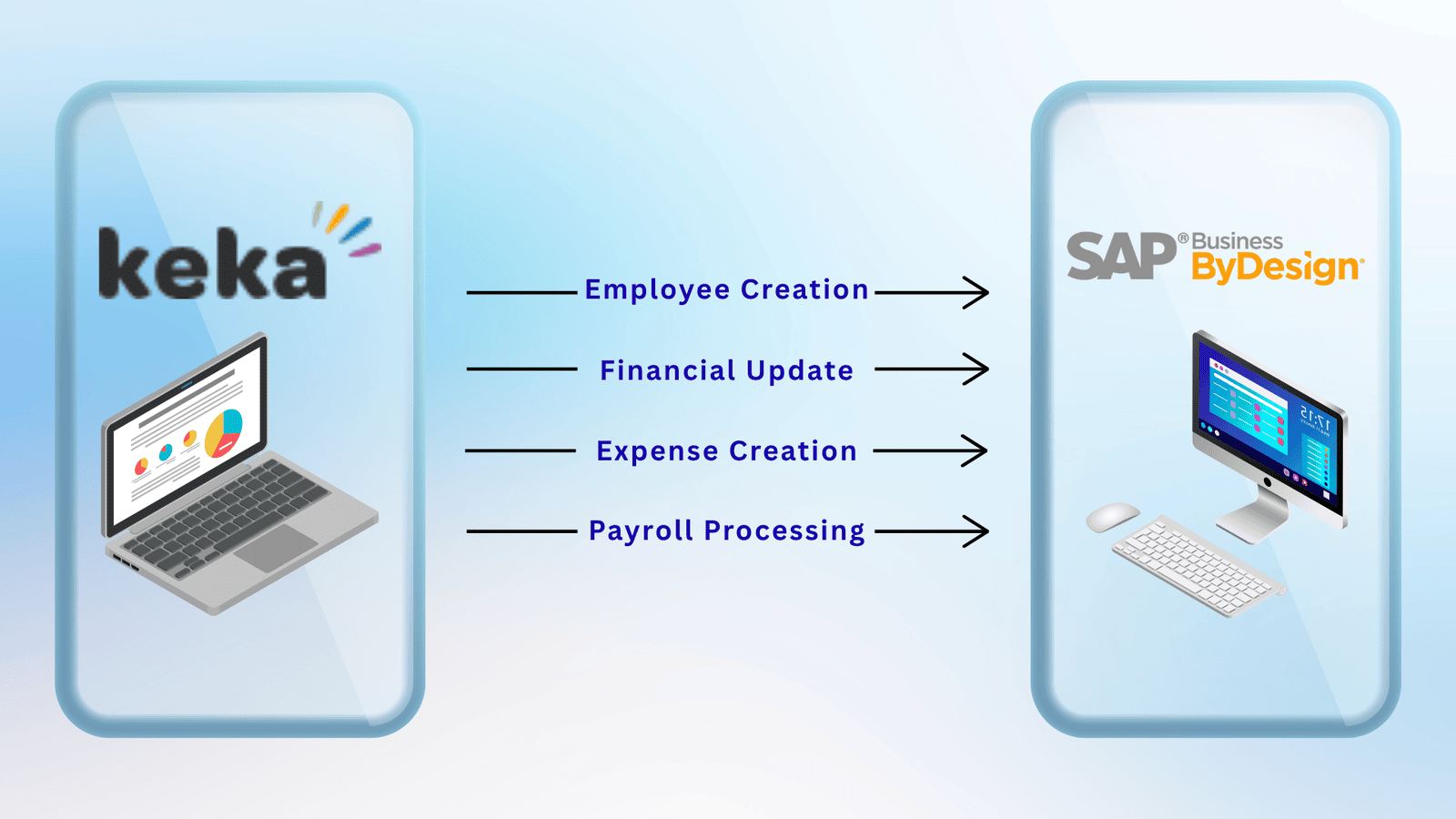

As our client organization experienced growth, they faced increasing challenges maintaining consistent HR and financial data across Keka HRM System and SAP Business ByDesign. To address this, we implemented an integration solution that automates synchronization of employee master data, financial det...

Our client, a semiconductor supplier, works closely with their customers to provide high-quality products. End customer maintains strict quality standards for all incoming materials from our vendors. Sales team & End Customers participate in the approval of the Quality information during the sal...

Our customer is a global semiconductor distributor who procures from Southeast Asia and distributes across Europe and the US. Credit insurance is quite important for the customer's business because of the nature of their business model and risks especially when dealing with high-value, long-credit, ...

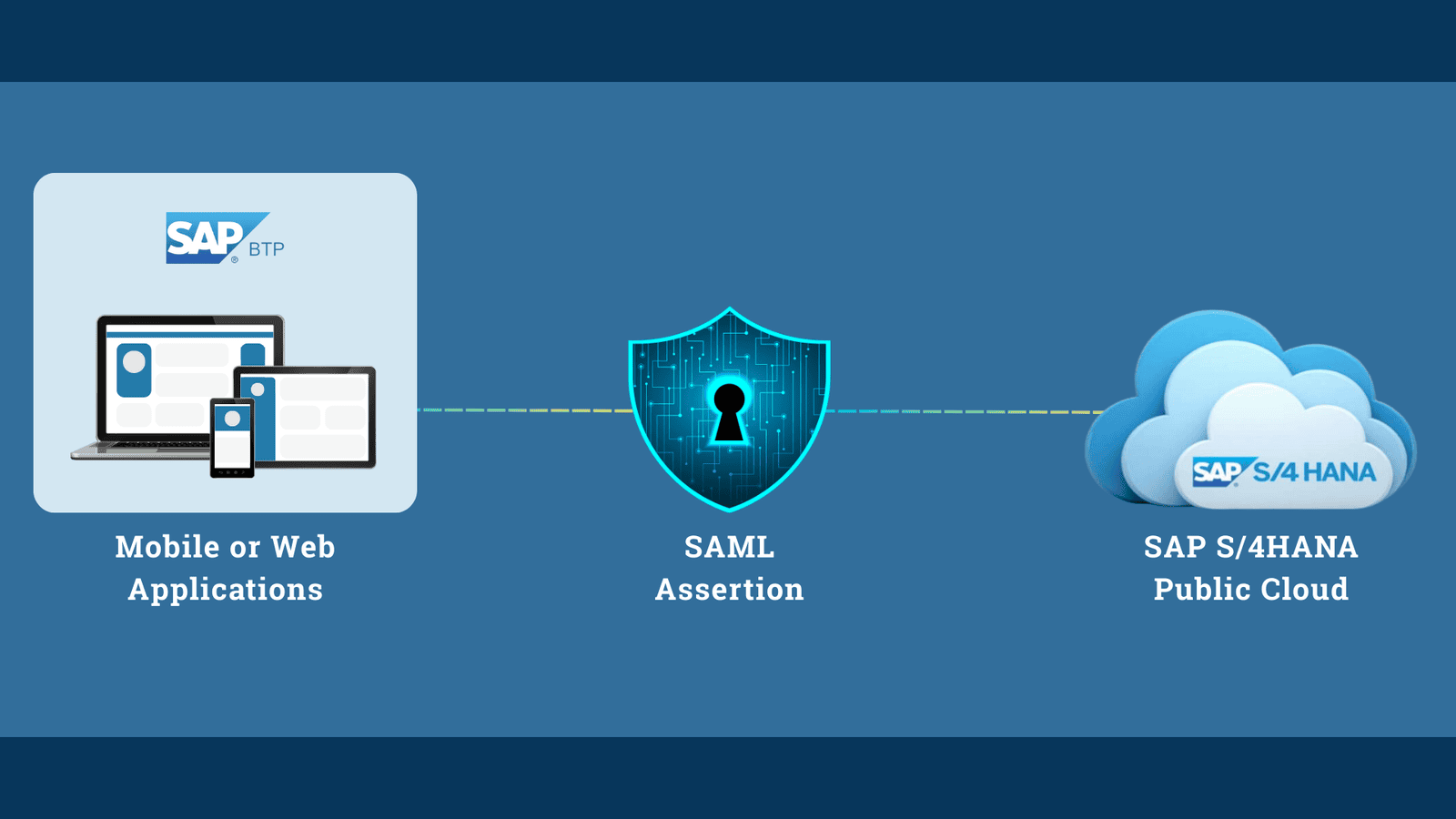

This blog post provides a comprehensive guide on establishing a SAML Assertion authentication method between an SAP S/4HANA Public Cloud and an SAP BTP (Business Technology Platform) applications. This setup allows you to securely access standard SAP APIs, such as those for Sales Orders and Purchase...

Managing Project tasks, Expenses, and Revenues manually in SAP Business ByDesign was labor-intensive and time-consuming, requiring users to repeatedly log in and manually update records. This cumbersome process prompted users to seek a more intuitive and efficient solution to streamline Project mana...

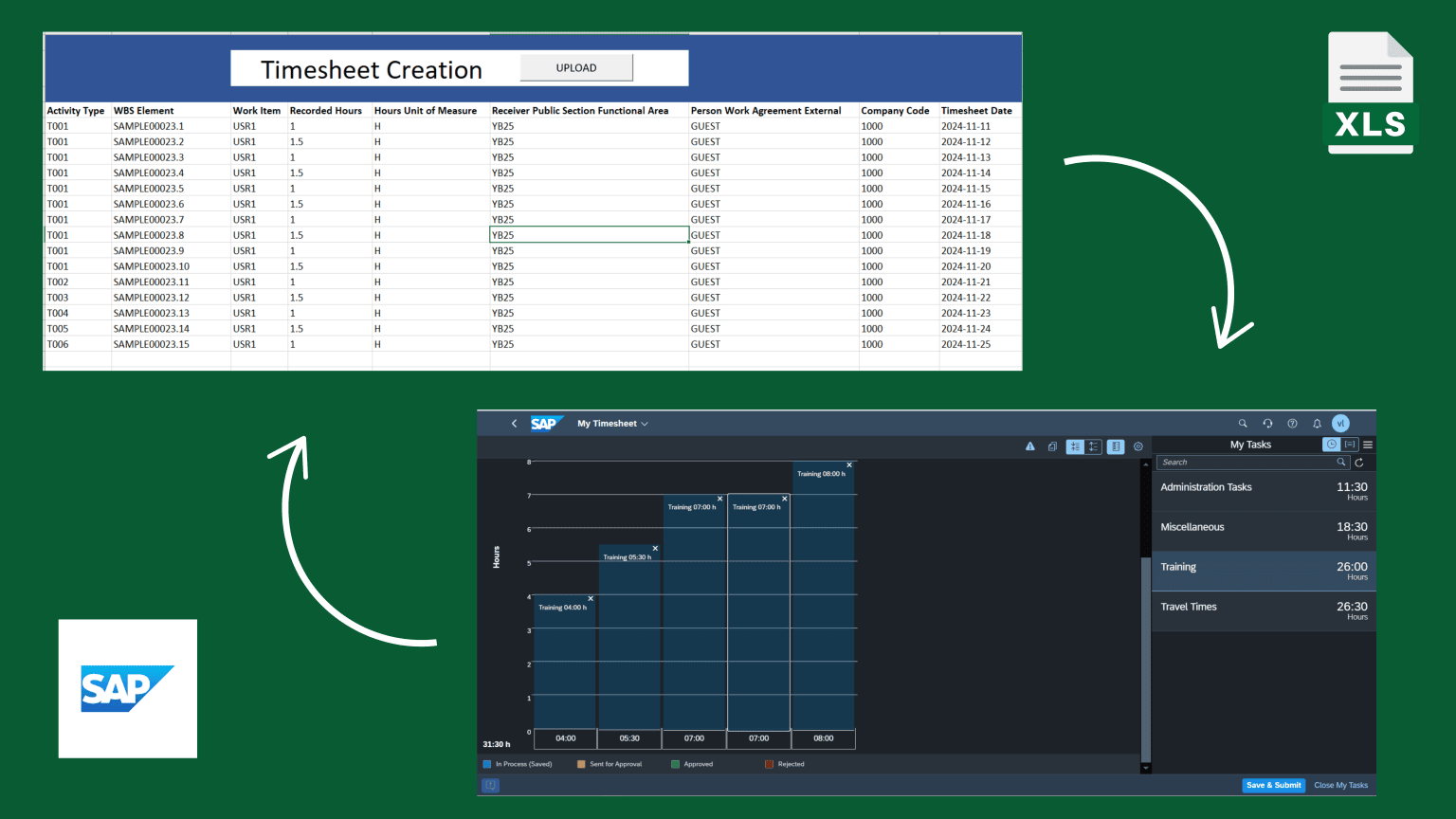

The SAP S/4HANA Public Cloud application is designed to handle multiple timesheet uploads for multiple users at the same time. However, because of license limitations, some users may not be able to access the timesheet app in the SAP S/4HANA public cloud system. During such instances, the manager ca...

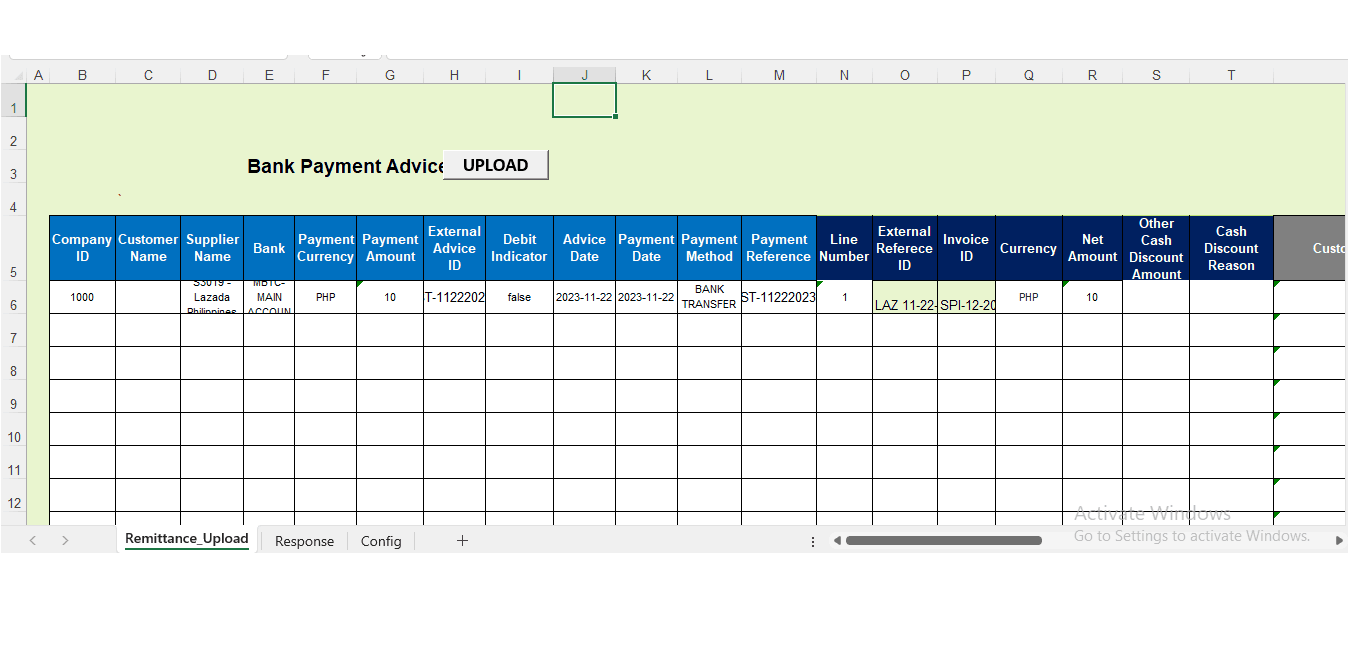

In situations where a large volume of payment advices must be uploaded, the standard approach of creating each payment advice individually becomes highly time-consuming and labor-intensive. Users require a more efficient and user-friendly solution to streamline this process and reduce the manual wor...

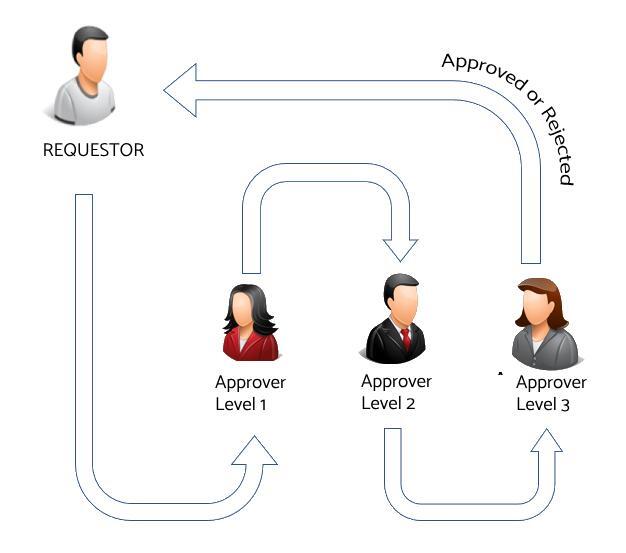

In the SAP Business ByDesign System, while predefined approval flows exist for standard objects, no such flows are available for custom business objects. As a result, users must design and implement a custom approval process tailored specifically to these custom objects.

Custom approval workflow is i...