Introduction

Our customer is a global semiconductor distributor who procures from Southeast Asia and distributes across Europe and the US. Credit insurance is quite important for the customer's business because of the nature of their business model and risks especially when dealing with high-value, long-credit, and global transactions.

Accurate and real-time information from Credit Insurers will give an edge to their business which led to the need of ICIC Israel - SAP S/4HANA Public Cloud integration.

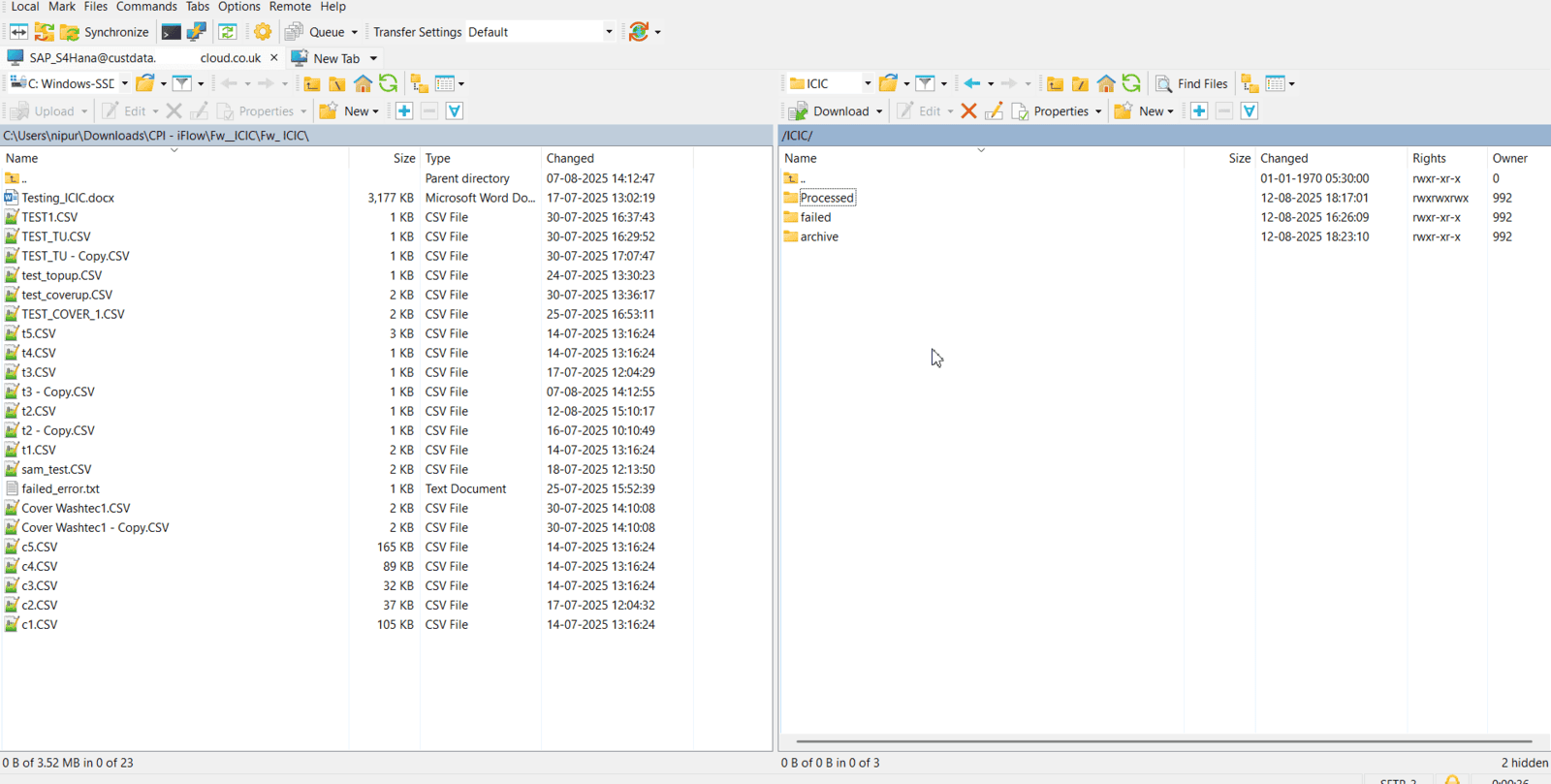

Credit details exported from Credit Insurers like ICIC to be uploaded to organization SFTP folder — but these details need to be synchronized to SAP S/4HANA Public Cloud’s Manage Credit Accounts application.

The challenge? SAP standard API support for Credit Management Master exists, although requires additional licensing to Advanced Credit Management (1QM). Customer was trying to look for a cost effective solution. To solve this, we built a custom integration approach that delivered automation, cost savings, and long-term flexibility.Business Requirement

At its core, the business wanted a hands-free integration of credit insurance details into SAP S/4HANA Public Cloud. The process had to:

- Pull CSV files from an SFTP server.

- Create or update entries in the SAP Credit Insurance Master using Integration Suite.

- Map Business Partner using the Reference ID from csv.

- Run automatically on a Job Schedule without manual work.

In other words, our customer needed a reliable, periodic, and accurate data pipeline from CSV → SAP S/4HANA cloud.

Challenges

On paper, the requirement looked straightforward — but the SAP system limitations quickly surfaced:

- No API for Basic Credit Insurance in SAP S/4HANA Public Cloud.

- Advanced Credit Insurance APIs exist, but with additional licensing costs.

- The business wanted an automated process, not a semi-manual workaround.

These constraints meant we had to innovate: design something lightweight, cost-efficient, and future-ready, without relying on unavailable APIs.

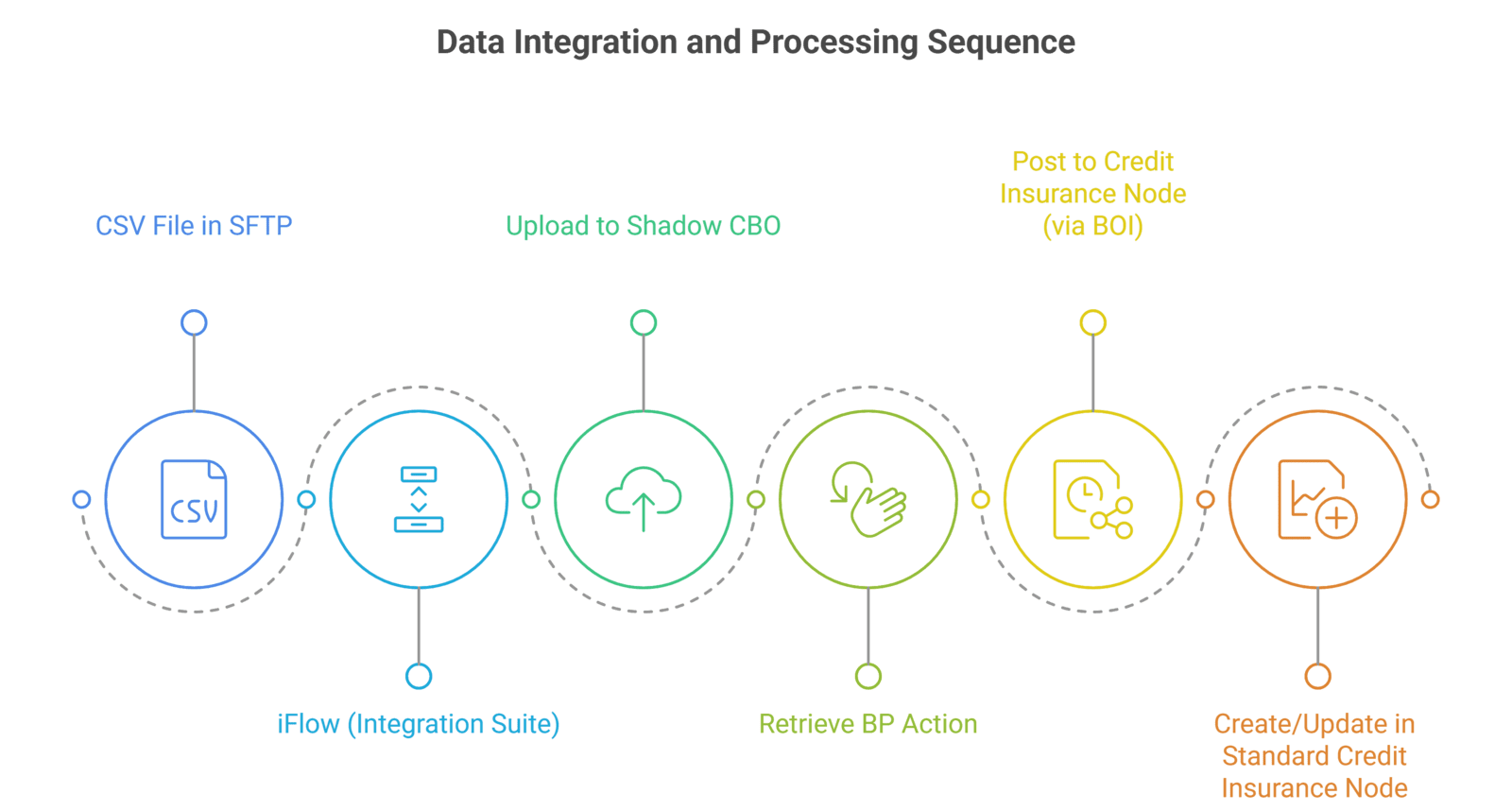

Solution Approach

We implemented a layered integration design using SAP Integration Suite and a Custom Business Object (CBO). This allowed us to stage data safely before posting it into the Credit Insurance node.

1. Data Integration via iFlow

- An SAP Integration Suite iFlow picks CSV files from the SFTP server.

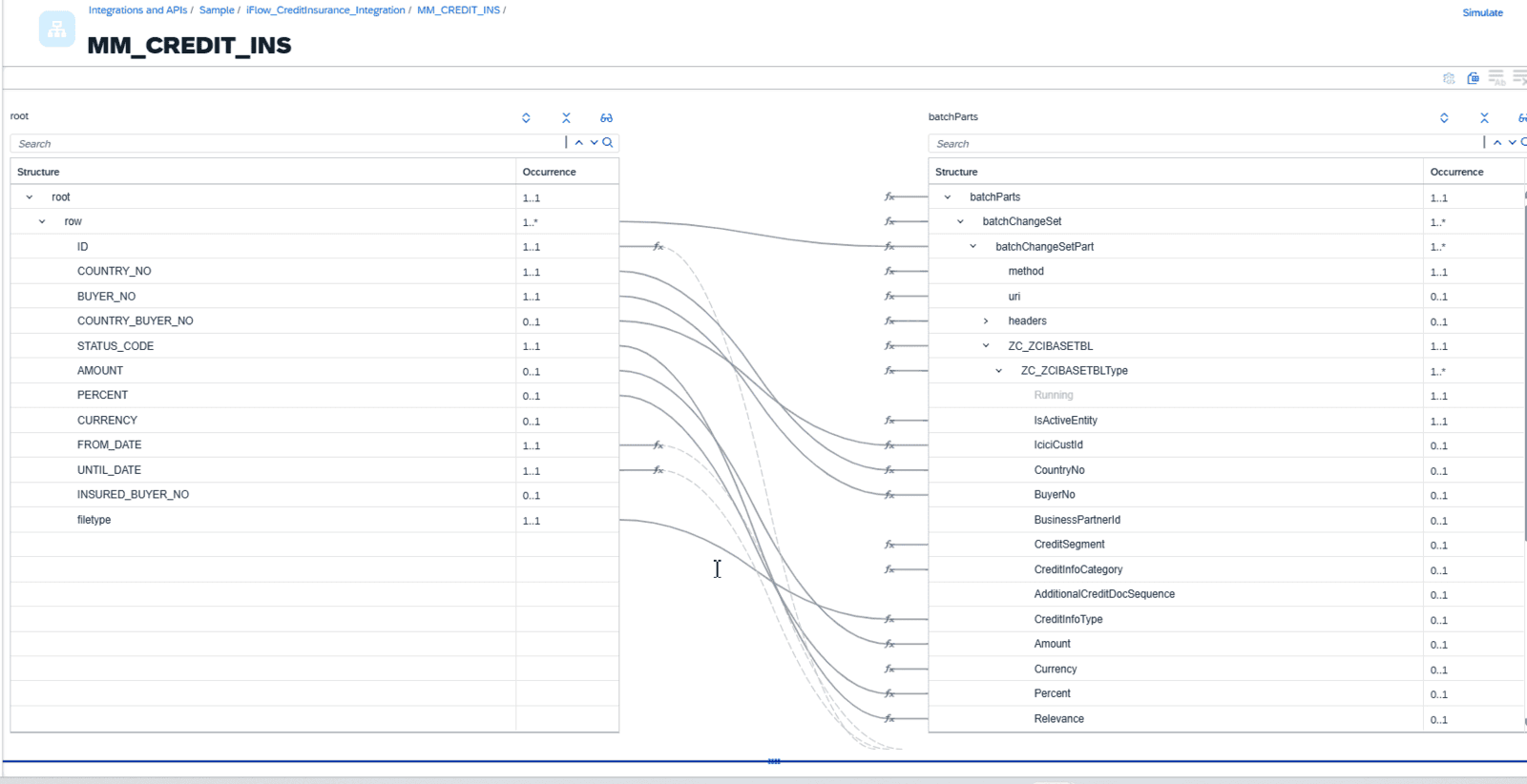

Message Mapping between CSV data and SAP Object model

- In this integration scenario, we are using SAP CPI message mapping functionality to transform the incoming payload from the input schema into the structure of our Custom Business Object (CBO) schema.

- The message mapping defines how each field in the source schema corresponds to the appropriate field in the target CBO schema.

- After the mapping is executed at runtime, the transformed message is passed to the CBO interface, which then creates the corresponding entries (records) inside the custom business object. This ensures that all incoming data from the external system is converted into the required format before being persisted in the CBO.

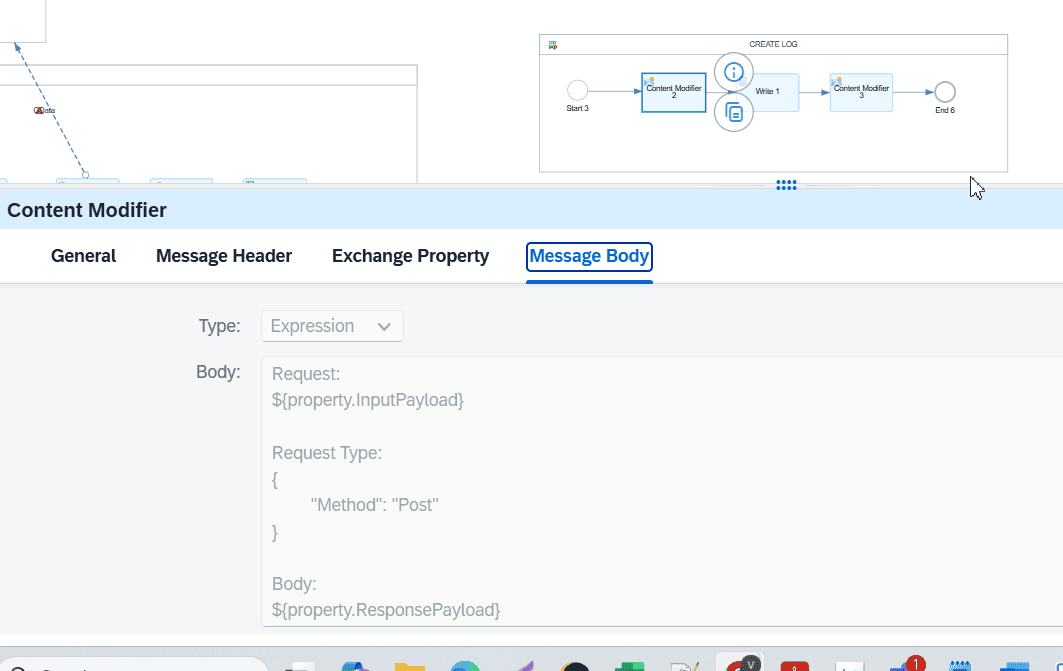

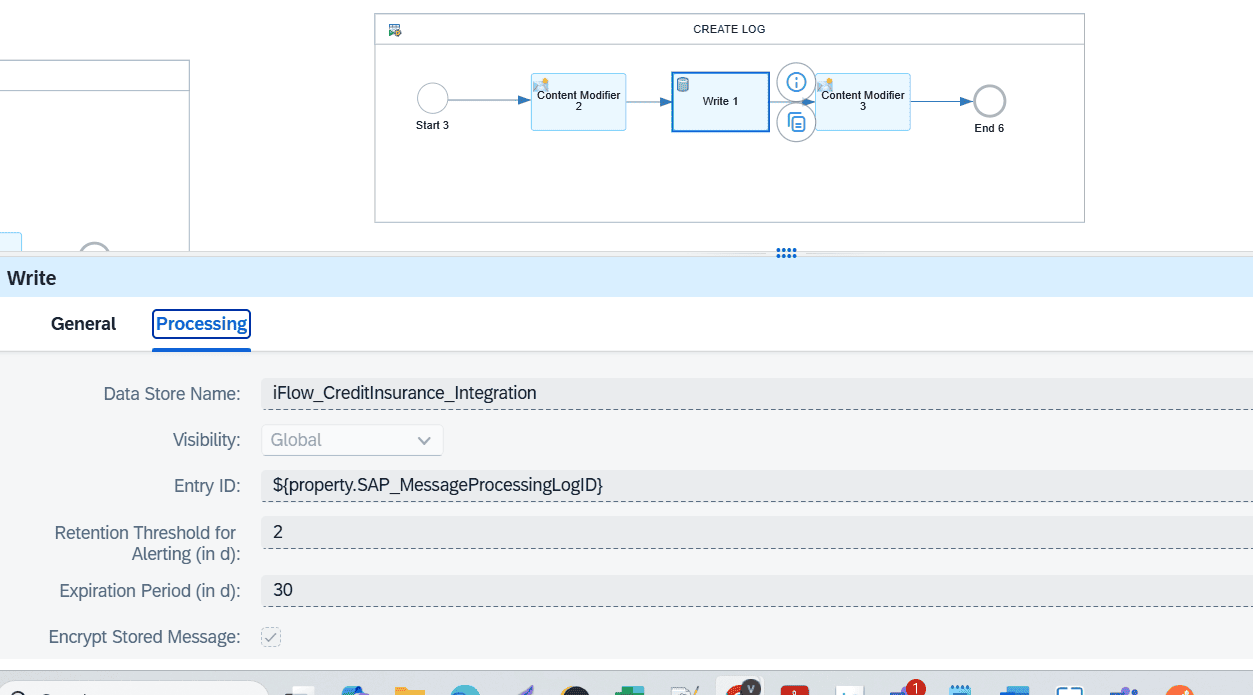

- In this process, we are also storing the log response of each file.

Iflow - Exception Handling

Iflow Log Creation

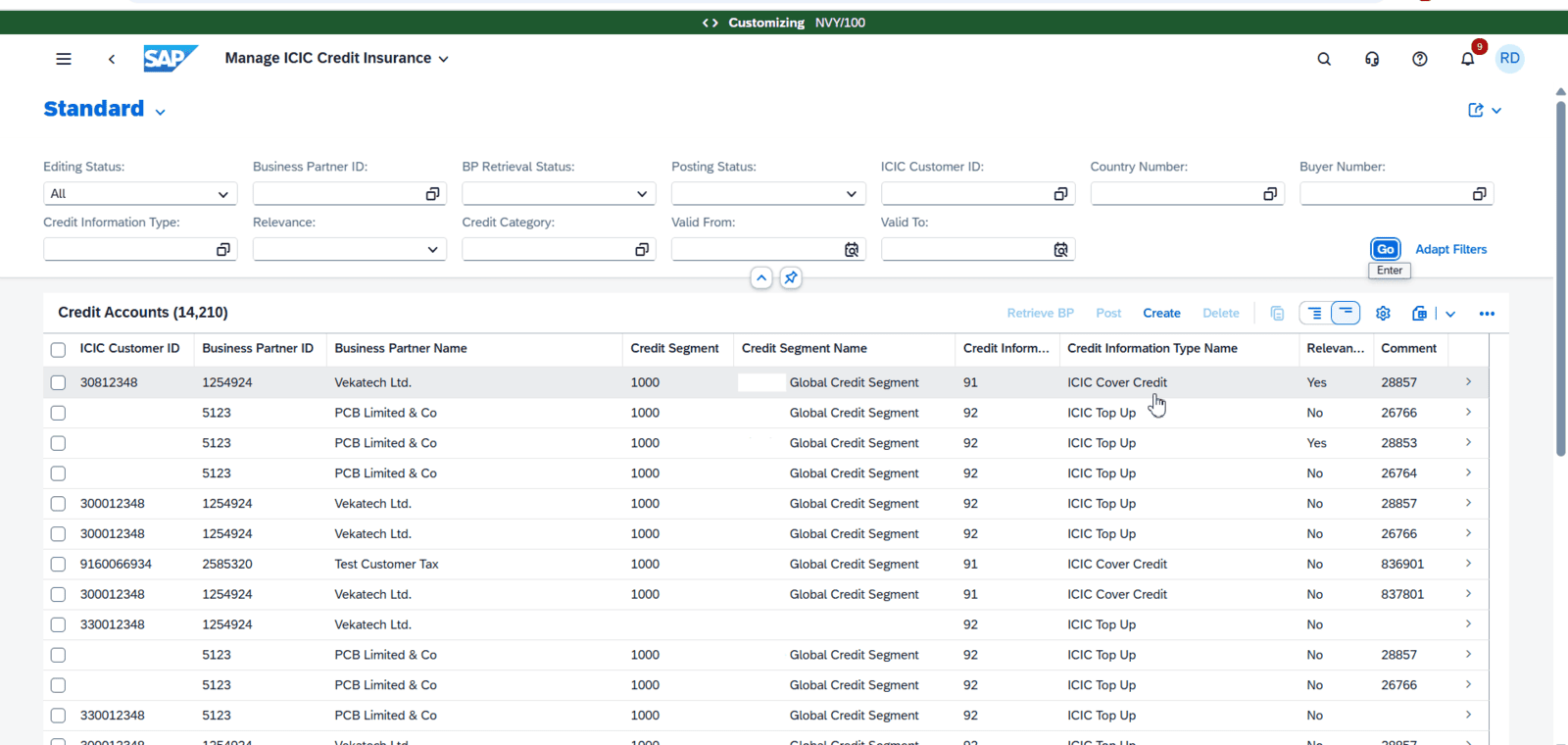

2. Shadow Object (CBO)

- A Custom Business Object was created in SAP S/4HANA Public Cloud. Structure of this custom business object mimicked with the SAP Standard Credit Insurance Node.

- Incoming CSV data is stored here first — acting as a shadow layer.

3. Custom Actions in CBO

Two custom actions handle the business logic:

- Retrieve Business Partner – Reads the ID from CSV data and finds the correct Business Partner in SAP S/4HANA Public Cloud.

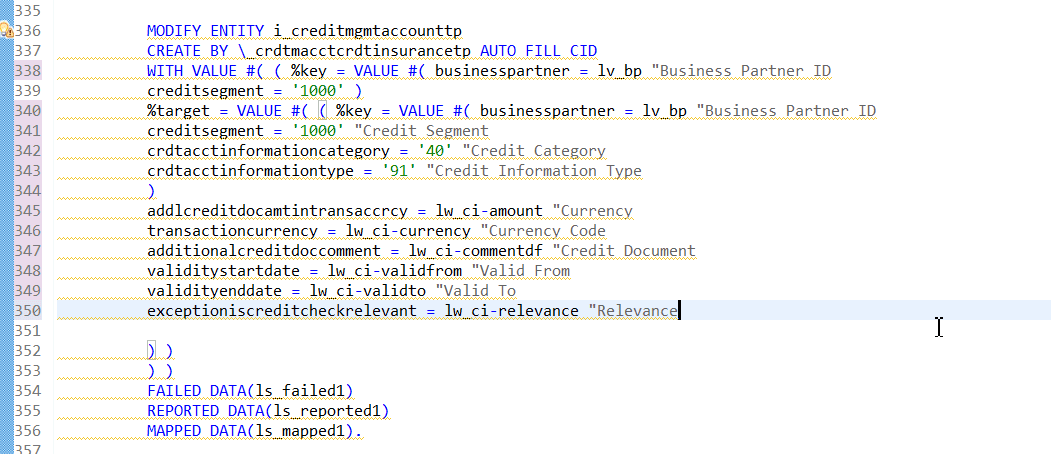

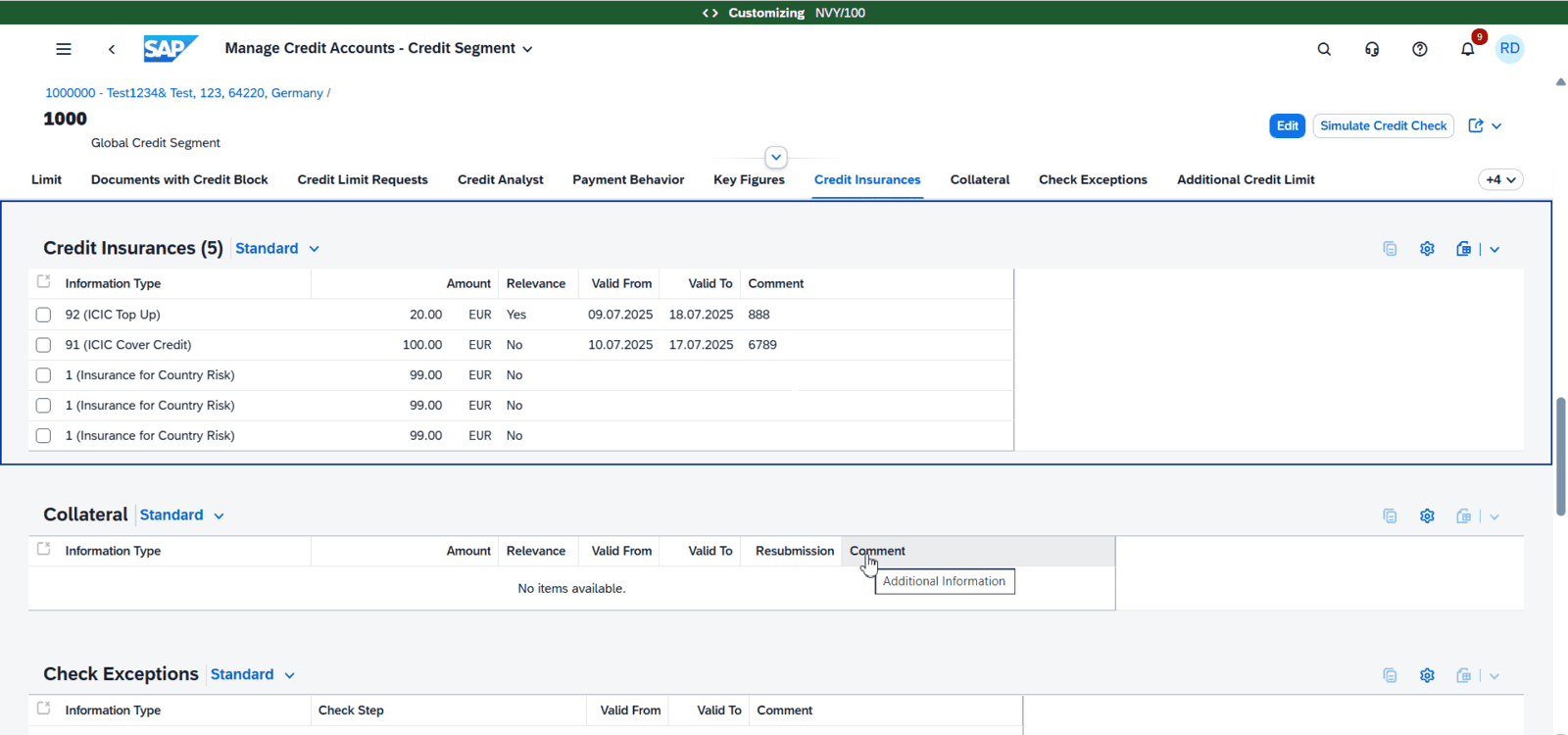

- Post to Credit Insurance Node – Uses Business Object Integration (BOI) to create/update entries in the standard Credit Insurance node.

- Reference: Credit Insurance BOI

Code snippet for creating record in the Standard Credit Insurance Node of Credit Management

4. Background Job Scheduling

- Both actions are scheduled as background jobs.

- Jobs run automatically at intervals, ensuring the Credit Insurance node stays synced with CSV source data.

Solution Flow (High-Level)

Visual Overview

SFTP SERVER where CSV Files maintained.

Shadow Object which is a mirror of the Credit Insurance Standard Node of "Manage Credit Accounts

Standard Credit Insurance Node.

Benefits

This custom design gave the customer more than just integration:

- Improved data accuracy by eliminating manual handling of CSVs.

- Faster credit decision-making thanks to near real-time updates.

- Better audit ability with logging of each integration run.

- Greater business confidence in managing high-value, global transactions.

- Enhanced Accuracy - Data synchronization minimizes the risk of errors associated with manual data entry, ensuring financial records are accurate and up-to-date.

Conclusion

SAP S/4HANA Public Cloud- ICIC integration case shows how to work around API gaps in SAP S/4HANA Public Cloud with a practical and scalable approach. By combining a shadow object (CBO) with automated job scheduling, we delivered a seamless integration.

This pattern is not just a one-off fix — it’s a blueprint for other organizations facing similar challenges.