Blog tagged as SAP Tax Compliance

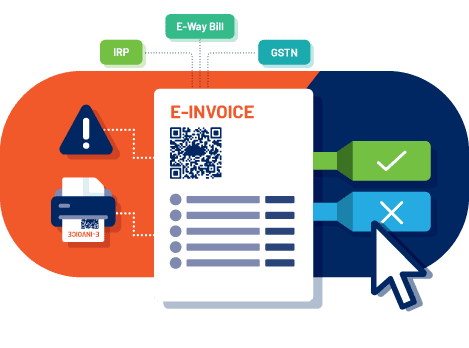

As per Indian GST regulations, businesses with an annual turnover exceeding ₹5 crore are required to generate an Invoice Reference Number (IRN) from the GSTN portal before issuing invoices to customers. To facilitate this, various GST Suvidha Providers (GSPs) offer integration between ERP systems an...