Introduction

The Israel Tax Authority (ITA) has mandated electronic invoicing for B2B VAT-registered transactions exceeding 25,000 ILS, effective from May 5, 2024. To comply with this regulation, we developed a custom solution using SAP’s standard eDocument framework to integrate SAP ERP Central Component (ECC) with the ITA portal.

While SAP Document and Reporting Compliance (DRC) is SAP’s official solution for such integrations, it often involves additional licensing and implementation costs. Our approach offers a cost-effective, custom alternative that avoids the use of SAP DRC while ensuring full compliance with Israel’s e-invoicing requirements.

In this blog, we explain how our SAP DRC-free integration enables seamless communication between SAP ECC and the ITA portal using the standard eDocument framework — helping businesses stay compliant without added overhead.

Prerequisites

Solution Overview

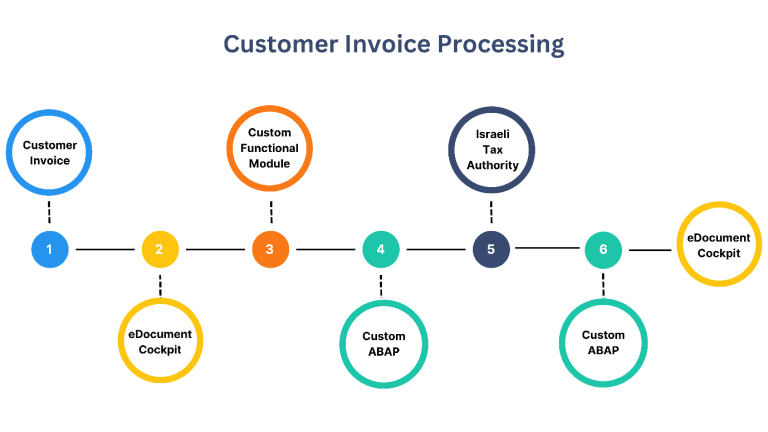

Customer Invoice Processing

Solution Steps

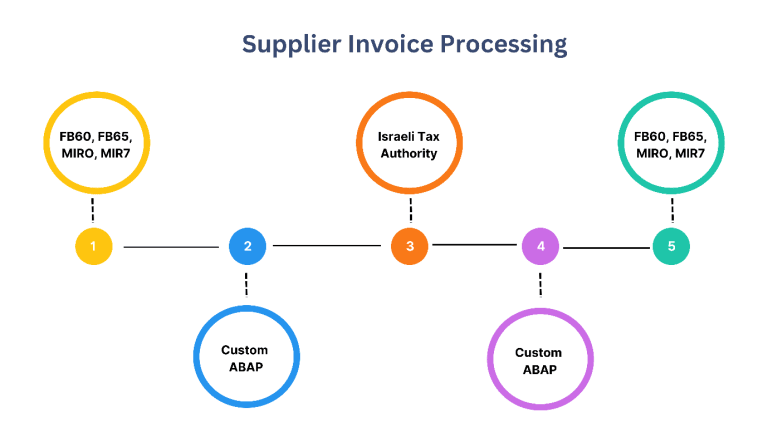

Supplier Invoice Processing

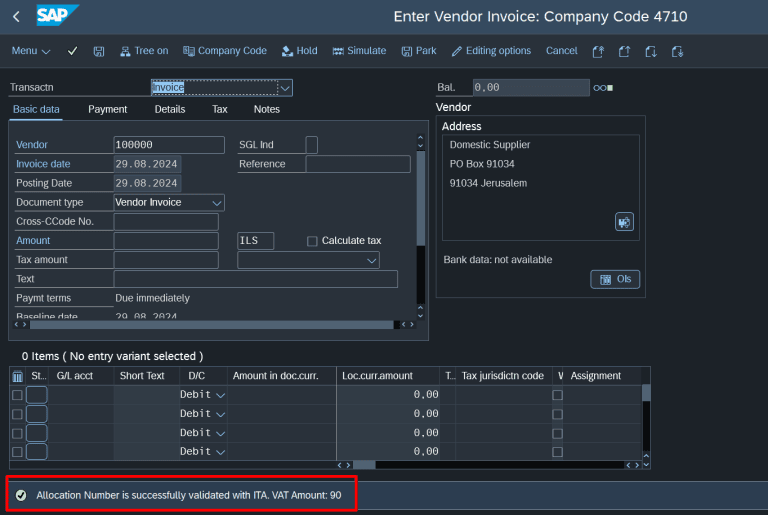

When you are using the standard SAP DRC solution to verify the allocation number, typically you cannot validate it without saving the invoice first. After saving the invoice, you should navigate to the eDocument cockpit screen to verify the allocation number.

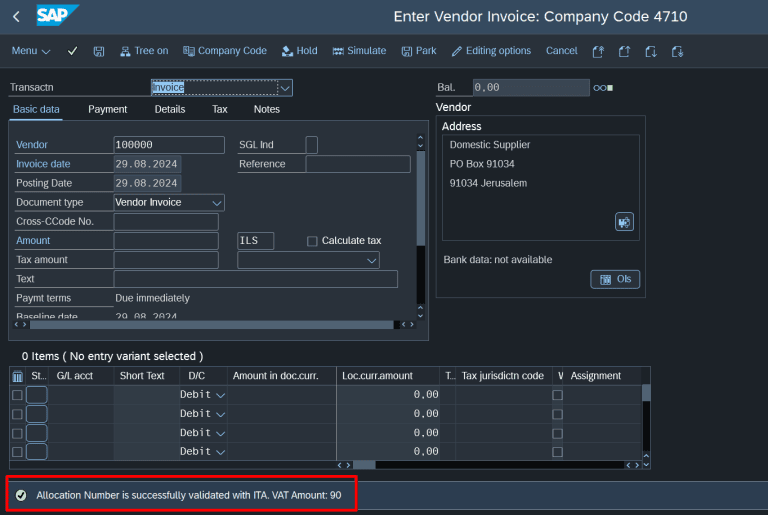

However, in our solution, we validate the allocation number immediately after users enter it. This eliminates the need for users to save it or switch to another screen to confirm the allocation; the allocation number can be validated directly from the same screen by this solution.

Solution Steps

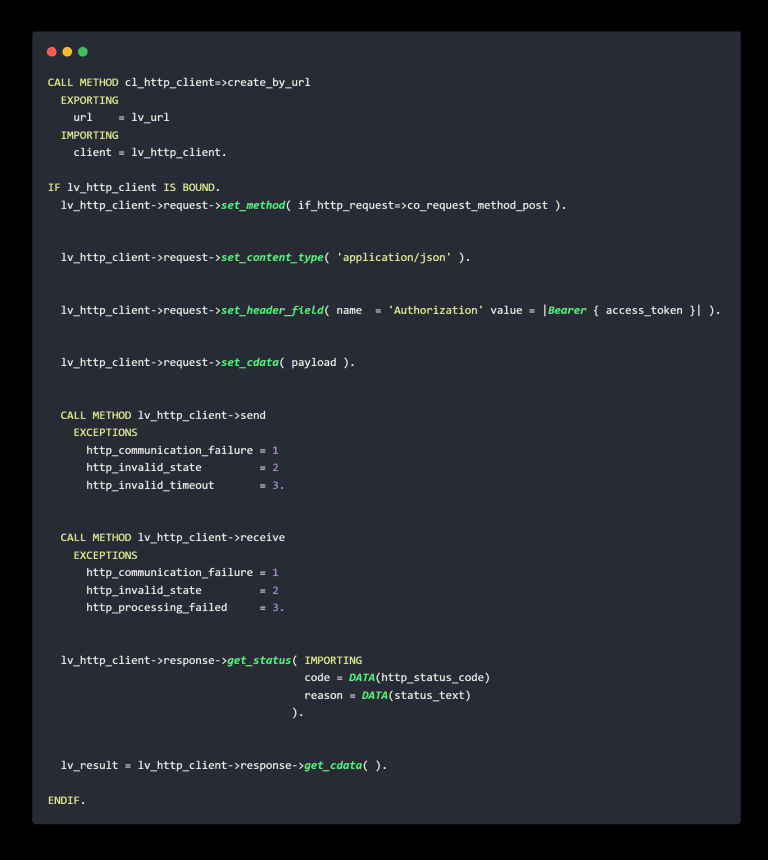

Implementation Details

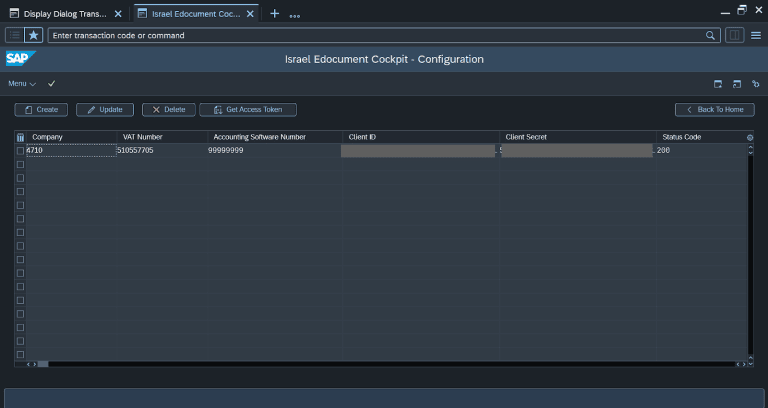

1. Creating a Customized Screen for Generating Access Tokens

2. SSL certificate upload

3. Customer Invoice

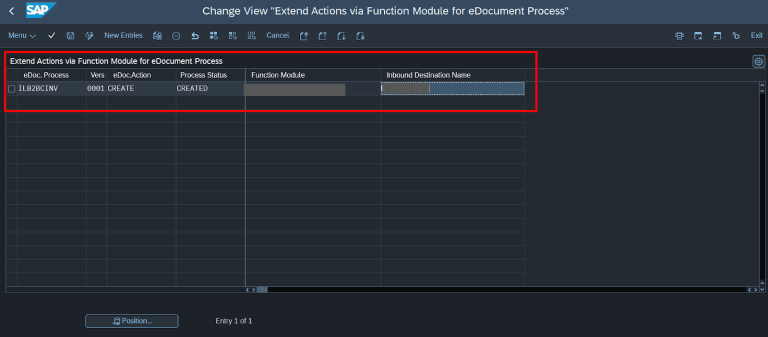

4. Supplier Invoice

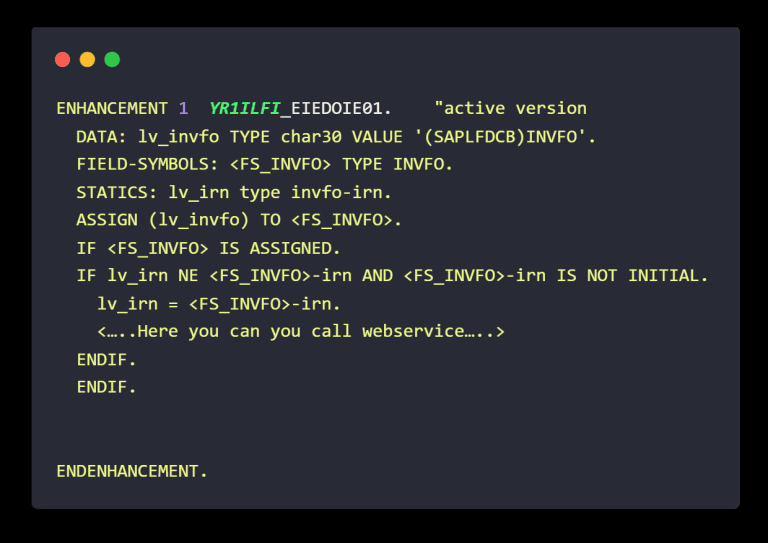

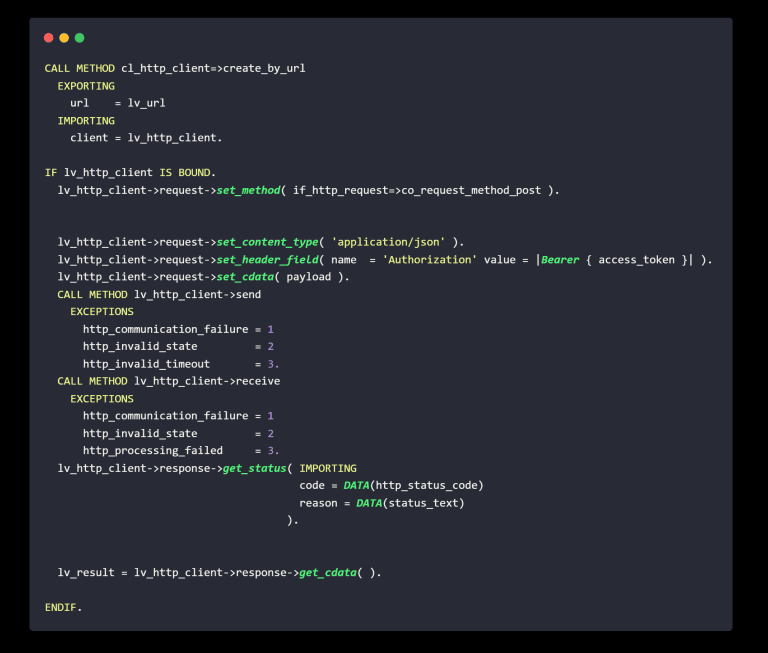

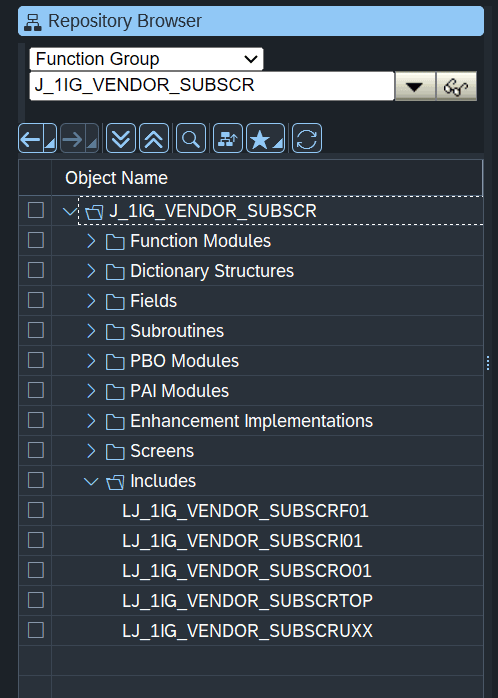

Then you can put your enhancement inside “LJ_1IG_VENDOR_SUBSCRF01”. This enhancement will be called automatically once the user enters the allocation number in IRN Field (within FB60, FB65, MIRO, MIR7).